"The Rich portfolio"...Lee Seung-gi, the influence of parents from bankers? The Admiring Asset Allocation Table (All The Butlers)

'All The Butlers' Lee Seung-gi revealed the Asset distribution table, and bought the envy of the members.

On the 28th SBS 'All The Butlers', Shuka appeared as a master and advised members about investment.

Shuka, who is working as an economic creator, appeared as a master. Shuka said, "When I worked as a pro-trader, I worked for a few hundred billion won, and when I was a fund manager, I was a group of funds because it was national money."

Shin Sung-rok begged Shuka to tell him about the stock, and Lee Seung-gi revealed that he "disposed all of the domestic stocks because this type of KOSPI fell a little." In response, Shin Sung-rok stated that he was "too scared when he fell"; Kim Dong-Hyun told Shuka's appearance: "Why do I go up when I sell and fall if I buy? I'm really curious. Are you looking at me? "I laughed and laughed.

"That's natural," said Shuka, "if you go up, you live. Of course there are times when you fall, and then you sell again. No one can match the short-term price. "

Shuka stressed that the Asset allocation was the first step in investment, followed by the members' Asset allocation table. Kim Dong-Hyun advised that there were only risk Assets such as stocks, virtual currencies, and real estate, and Shuka should allocate Assets to secure safety Assets. Shin Sung-rok said that real estate and loans were 40 percent each and stocks 20 percent, which is the general portfolio of the nation. Yang Se-hyeong had 75% of the shares, but secured safety Assets such as pensions and deposits, and had his own clear goal. Shuka praised Yang Se-hyeong for saying that he should approach.

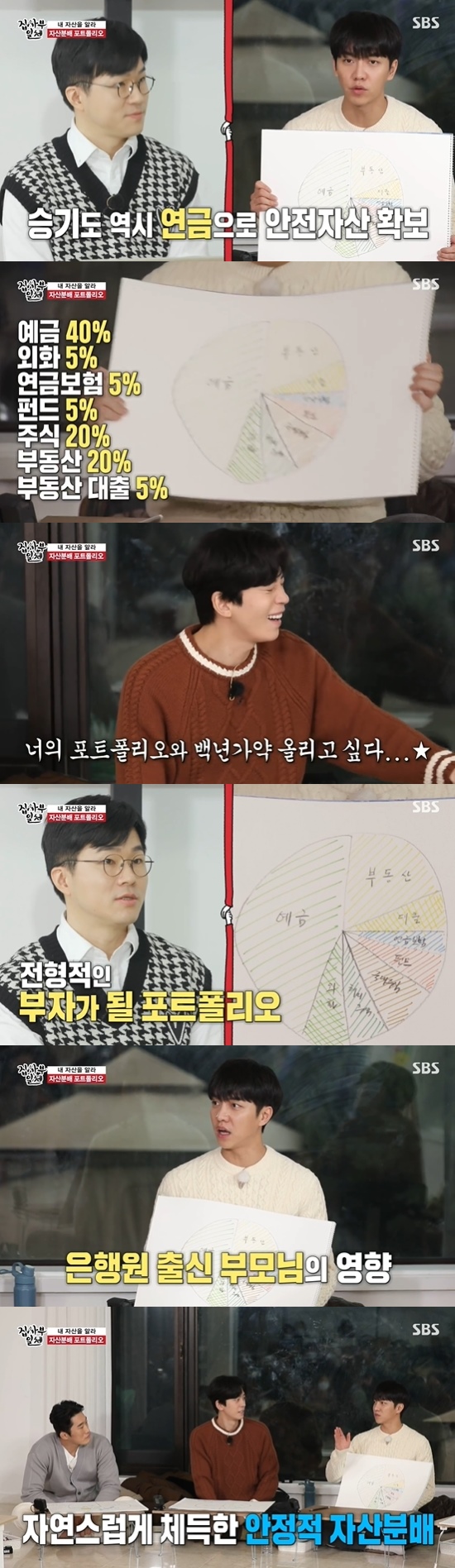

The following is Lee Seung-gi's portfolio; Lee Seung-gi's deposits accounted for the largest portion with 40%, while stocks and real estate accounted for 20%. Foreign currency, pension insurance, funds and real estate loans were 5% each, and Shin Sung-rok, who saw them, smiled, holding his hand gently, saying, "Can't you marry me?" Kim Dong-Hyun also said, "It's too much to be a sucker," and Yang Se-hyeong said, "I did well." Shuka said that Lee Seung-gi's portfolio was a typical rich portfolio. Lee Seung-gi revealed that he had reliably distributed Asset due to the influence of his parents, who were former bankers.

The first time he bought a stock on the day of recording, Jung Eun-woo was a deposit except for one stock. "If my brothers talk about stocks, I'm interested, but I'm not sure I should care about it," said Jung Eun-woo. "I have to invest even if I do not own stocks." Jung Eun-woo asked if he should invest in Risk Asset, and Shuka said, "As time goes by, I will feel that the growth rate of Asset is insufficient compared to the surroundings. The Asset gap widens. "

Schuka, meanwhile, has said about the investment direction to pay attention to in 2021: study and imagine climate change and digital transition. Lee Seung-gi, who became a student of Shuka classroom honors, saw Shuka's investment stocks.

Photo = SBS Broadcasting Screen