"Typical Rich portfolio" Lee Seung-gi, Actual Asset Allocation Table...Shukado 'Acknowledgment' (All The Butlers')

"All The Butlers" Shuka admitted to Lee Seung-gi's Asset allocation table as "a typical rich portfolio."

On the 28th, SBS All The Butlers' appeared as a master of the Investment specialist Shuka, called 'The Messiah of the Jurin', and gave a lecture on Investment tweezers.

Shuka said, "I used to be a pro-trader and fund manager, but now I am a schnastic creator." The members wondered about the amount of funds that Shuka had managed at the time of the pro-trader, and Shuka was surprised to say, "When I worked as a securities company pro-trader, it was a few billion won, and when I was a fund manager, I was surprised.

Lee Seung-gi revealed that Shin Sung-rok asked Shuka to tell him about the stock, saying, "This brother has disposed of all Korean stocks because the KOSPI has fallen." Shin Sung-rok then said: "I was so anxious that I sold it all out; I was so scared when I fell." Kim Dong-Hyun, Who is as good as Shin Sung-rok, said, "I do not know why I sell, I buy, I buy, I do not buy a lot, I do not buy a little. Who are you watching me? "

In the complaint of the two, Shuka said, "If you move at a price, it is natural to get caught in such a trap. Short-term prices are actually nothing, so why did I buy them? If this does not change, going to long-term Investment is actually a way to keep money. "

Shuka said, "I have risen about 200% in a year and a half" to the highest return question recently. In the meantime, he said that he would disclose the Investment portfolio, which includes the events he actually invested, to the members of the honor students Who listened to the lecture the most hard.

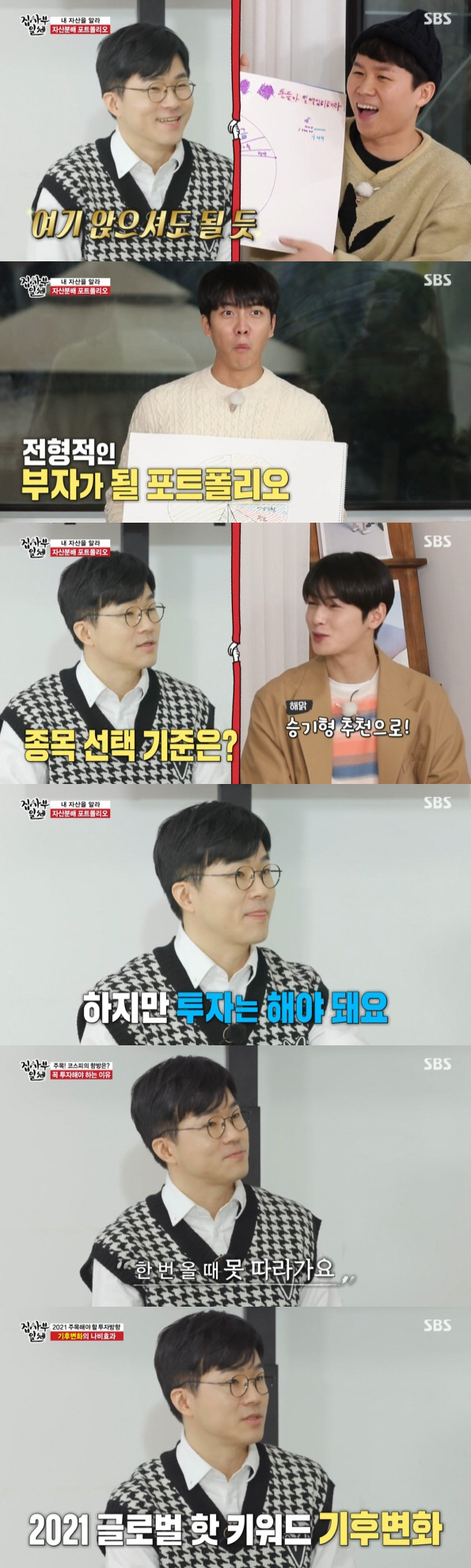

On this day, the members released their Asset distribution table, which consists of deposits, real estate, and stocks. Shuka stressed that the Asset allocation table was "the first step in all Investments."

First, Kim Dong-Hyun unveiled a Simple Asset allocation table of 30% of stocks, 20% of virtual currencies, 25% of real estate and 25% of real estate loans. "I was originally 50 percent of the stock, but I went to Coin because I liked virtual money these days," he said.

"There is no safety Asset at all, it's 100% risk Asset, in fact not 100%. "The loan is eventually borrowed money, so I invested in the 125% risk Asset," he said. "If you make a profit, you should think about turning it to a little safe Asset or preparing." Kim Dong-Hyun vowed, "Today is the opportunity of heaven, and I will change after today."

Shin Sung-rok has unveiled a Simpler Asset allocation table than Kim Dong-Hyun, with 20 percent of shares, 40 percent of real estate and 40 percent of real estate loans. "It is a general Asset distribution of our people. Real estate accounts for 80% of my Asset," Shuka said. "In fact, it is a very aggressive Investment. I bought an expensive house. I did a fairly aggressive Investment. "

Yang Se-hyeong has released an Asset distribution table of 6% pension, 10% deposit, 4% loan, 5% subscription and 75% stock. "If you do not have real estate among our young people, you are the most aggressive but the most frequent portfolio these days," Shuka said. "It is a very aggressive Investment, but it is rational."

Yang Se-hyeong said, "I will leave it until I am 49 years old. When I think that I get 10% annual return, it will be about 3.14 times my principal in 12 years. Investment is also good, stable and can see the future, "Shuka said." Is not the Investment goal certain? "When you are stocking, you have to approach it like that."

Lee Seung-gi then surprised everyone by releasing a net set allocation table of 40% deposits, 5% foreign currency, 5% pension insurance, 5% fund, 20% stock, 20% real estate and 5% real estate loan. Shuka also admitted that it was "a typical rich portfolio"; Lee Seung-gi explained, "There are things that parents do stable because they are both bankers."

Finally, Cha Eun-woo revealed a pure Asset distribution table of 100% deposits and said, "I am interested in (stock) but I am not confident to care." "I do not have to do stocks, but I have to do Investment," Shuka said. "If I do not do Investment, I feel that the growth rate of Asset is slower than the surroundings." He warned.

On this day, Shuka cited climate change, digital conversion, and the end of the kitchen in the direction of Investment, which should be noted in 2021, referring to the hottest industrial sector and economic outlook. In addition, we have also introduced Investment honey tips such as 'Imagine the Blue Ocean field before digital conversion', 'Pay attention to the direction of the company presented by the CEO', and 'Choose a company with high entry barriers'.

Shuka said, "Do not forget the KOSPI chart before I invest. Do not be impatient. I want you to think that 'opportunity is not short, but it comes to me for a long time.'" It's okay to buy in installments. If you invest at once and taste a big risk, you will not look at the stock again and you will have trauma, so it would be a good idea to think about buying a split. "

On the other hand, Lee Seung-gi, Who was selected as an honor student on the day, saw Shuka's Investment portfolio and said, "I thought there would be a special event. I think I have everything like transportation, electricity, and battery. "