Family company set up, Down contract 'Tax evasion' celebrity...Lee Min-ho and Ha Jung-woo "We're Not"

Celebrity entertainer A has been reported to have been caught in the recent billions of won in the recent scandal after the establishment of an entertainment agency in the name of his family, and entertainers who run several family names are not "we are not".

The company announced on April 4 that it has launched a tax investigation on 38 people suspected of Tax evasion Lu Han. "We have completed the tax investigation of several suspects, including Mr. A, and we will launch a new tax investigation of 38 suspected unfair Tax evasion suspects, including booming cash Tax evasions, corporate funds private use, and foul privilege Tax evasions," said Roh Jung-seok,

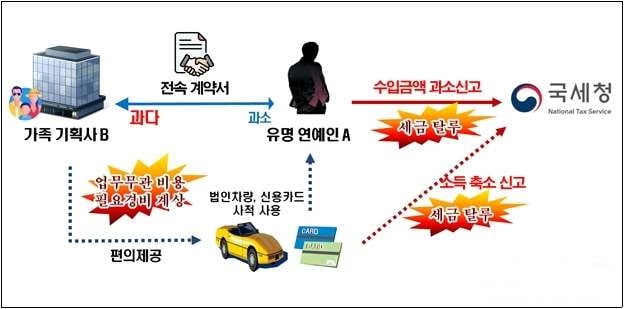

Mr. A in question established an entertainment agency run in the name of his family, and he wrote a kind of "Down" contract. This is an act committed to pay less taxes, considering that there is a difference between the corporate tax rate (up to 25%) and the personal income tax rate (42%).

As a result, Mr. A paid less taxes due to reduced income, and the agency handled deductible expenses by using imported cars and credit cards of corporate names to reduce corporate taxes imposed on incomes that were higher than actual income.

In addition, he paid labor costs to relatives who had never actually worked. The company collected billions of won in comprehensive income tax and corporate tax on Mr. A and his agency. In the meantime, several entertainers' Tax evasion has been caught, but Mr. A's Tax evasion method has attracted more attention because he was first caught.

After the announcement of the revenue, suspicions emerged that some Actors belonging to family-run entertainment agencies such as Lee Min-ho and Ha Jung-woo were "Lu Han" to deduct the tax. Lee Min-ho agency MYM Entertainment is named by sister, Ha Jung-woo agency workhouse company is named by brother as representative.

Lee Min-ho, a member of the agency, said, "We are not," he said to Hankyung.com on April 4, "We are not using foreign cars, and we are thoroughly making mistakes so that we do not miss mistakes as we are so interested in taxes."

Ha Jung-woo, a member of the agency, also said, "We are not."

Meanwhile, Roh Jung-seok, director of the investigation, said, "We will carefully clean up the Corona 19 crisis and prevent it from hindering the economic recovery, but we will strictly respond to anti-social Tax evasion activities such as corporate fund private use and negative cash transactions."

revenue, famous entertainer Tax evasion caught less income, high income income tax rate damage, famous entertainer A and entertainment agency tax